Browsing the Complexities of Forex Trading: Just How Brokers Can Aid You Keep Informed and Make Informed Decisions

In the hectic globe of forex trading, staying informed and making well-informed decisions is essential for success. Brokers play a vital function in this complex landscape, providing competence and support to browse the complexities of the marketplace. But exactly how specifically do brokers help traders in staying in advance of the contour and making notified choices? By checking out the ways brokers provide market analysis, understandings, threat monitoring strategies, and technological devices, investors can gain a deeper understanding of exactly how to properly leverage these resources to their advantage.

Function of Brokers in Foreign Exchange Trading

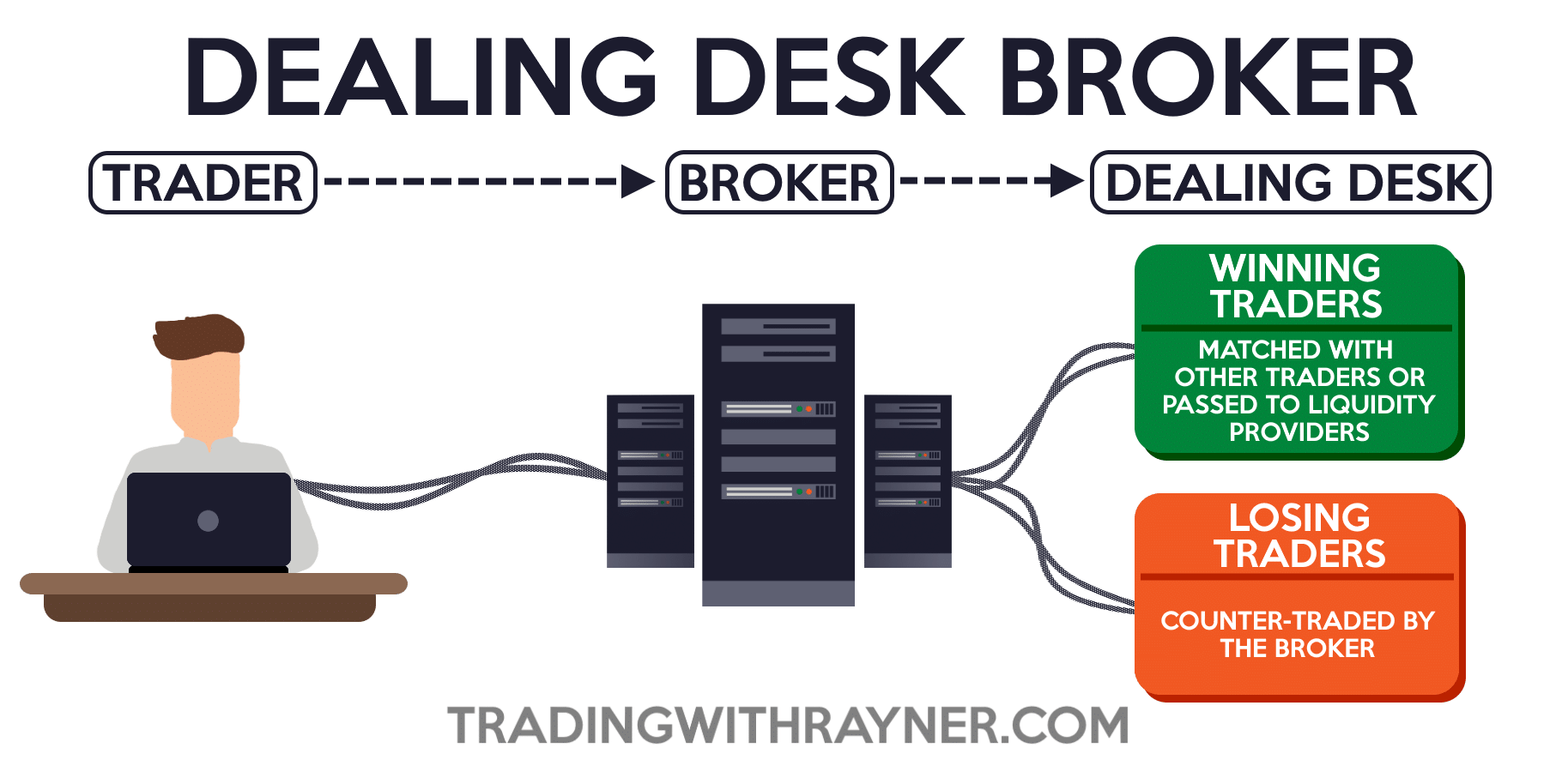

In the realm of Foreign exchange trading, brokers play a critical role as middlemans promoting transactions between investors and the worldwide currency market. forex brokers. These financial professionals work as a bridge, attaching specific investors with the complicated and huge world of fx. Brokers give a platform for investors to access the market, offering devices, resources, and market insights to assist in making informed trading choices

One of the key functions of brokers is to perform professions in behalf of their customers. Through the broker's trading platform, traders can offer and purchase money pairs in real-time, making the most of market changes. In addition, brokers use take advantage of to investors, permitting them to control bigger positions with a smaller quantity of resources. This feature can enhance both losses and revenues, making danger administration an important aspect of trading with brokers.

Moreover, brokers give valuable instructional sources and market evaluation to assist investors browse the complexities of Foreign exchange trading. By remaining educated about market fads, economic indicators, and geopolitical events, investors can make critical choices with the advice and assistance of their brokers.

Market Evaluation and Insights

Providing a deep study market trends and using valuable insights, brokers outfit investors with the needed tools to browse the intricate landscape of Forex trading. Market evaluation is a vital element of Forex trading, as it includes checking out numerous factors that can affect money rate motions. Brokers play a pivotal role in this by supplying traders with up-to-date market evaluation and understandings based upon their competence and research study.

Through technological evaluation, brokers assist traders understand historical cost data, identify patterns, and predict possible future price motions. Additionally, fundamental evaluation enables brokers to evaluate economic indications, geopolitical events, and market news to examine their effect on money worths. By manufacturing this details, brokers can supply traders valuable insights into prospective trading possibilities and dangers.

Furthermore, brokers often give market reports, e-newsletters, and real-time updates to keep investors notified concerning the latest advancements in the Foreign exchange market. This continuous flow of information enables traders to make educated decisions and adjust their approaches to changing market conditions. Overall, market evaluation and understandings provided by brokers are important tools that encourage investors to navigate the vibrant world of Forex trading successfully.

Risk Administration Strategies

Navigating the unstable surface of Forex trading necessitates the execution of robust risk administration approaches. In the world click this of Foreign exchange, where market changes can take place in the blink of an eye, having a strong risk administration plan is crucial to protecting your investments.

Remaining notified regarding global financial occasions and market information can aid you prepare for potential threats and adjust your trading strategies as necessary. Inevitably, a disciplined approach to take the chance of administration is crucial for lasting success in Foreign exchange trading.

Leveraging Modern Technology for Trading

To successfully navigate the complexities of Forex trading, utilizing sophisticated technical tools and systems is necessary for maximizing trading techniques and decision-making procedures. In today's hectic and dynamic market environment, traders count heavily on modern technology to obtain an one-upmanship. Among the key technical improvements that have actually revolutionized the Forex trading landscape is the growth of trading platforms. These platforms supply real-time data, advanced charting devices, and automated trading abilities, permitting traders to execute trades successfully and respond rapidly to market activities.

Additionally, algorithmic trading, additionally referred to as automated trading, has actually ended up being increasingly popular in the Foreign exchange market. By utilizing formulas to assess market conditions and execute trades automatically, traders can get rid of human feelings from the decision-making process and make use of opportunities that arise within nanoseconds.

Furthermore, using mobile trading apps has actually empowered traders my company to stay linked to the look at this site market whatsoever times, allowing them to monitor their settings, receive informs, and location trades on the go. On the whole, leveraging innovation in Forex trading not only enhances performance yet likewise provides traders with important insights and devices to make educated decisions in a very open market setting.

Creating a Trading Strategy

Crafting a distinct trading plan is essential for Foreign exchange traders aiming to navigate the complexities of the marketplace with accuracy and tactical foresight. A trading strategy functions as a roadmap that describes a trader's objectives, threat tolerance, trading techniques, and method to decision-making. It aids traders preserve discipline, handle emotions, and remain concentrated on their objectives among the ever-changing characteristics of the Forex market.

Conclusion

In final thought, brokers play a critical function in helping investors navigate the complexities of forex trading by giving market evaluation, insights, threat administration techniques, and leveraging innovation for trading. Their proficiency and guidance can aid investors in making notified decisions and creating effective trading strategies. forex brokers. By functioning with brokers, traders can remain notified and increase their possibilities of success in the foreign exchange market